Boost Your Paycheck in 15min!

Introduction

We are officially three weeks past Tax Day 2022. Over 63 million Americans are expected to receive a refund from the IRS this year. The average refund is $3,226, which is an 11.5% percent increase from 2021.

A refund from the IRS indicates that you have overpaid in taxes the prior year. And while a refund is better than an end of year tax bill and you might like the feeling of getting a big check from the IRS, it means that you have essentially lent money to the government at a 0% interest rate. If you are carrying debt that carries a balance, you could have been using that money to get out of debt and saving yourself significant amounts of interest. If you are already debt free, you could have been investing that money instead!

Taking the time to check your withholdings after each tax season is important for two reasons. First, it protects you against having too little tax withheld and facing an unexpected tax bill and underpayment penalty. Second, it gives you the opportunity to adjust your tax withheld up front, resulting in a bigger monthly paycheck.

So, this month, we want to give you the tools to make these adjustments and be better prepared for next year's tax season!

How to Calculate your Tax Withholdings

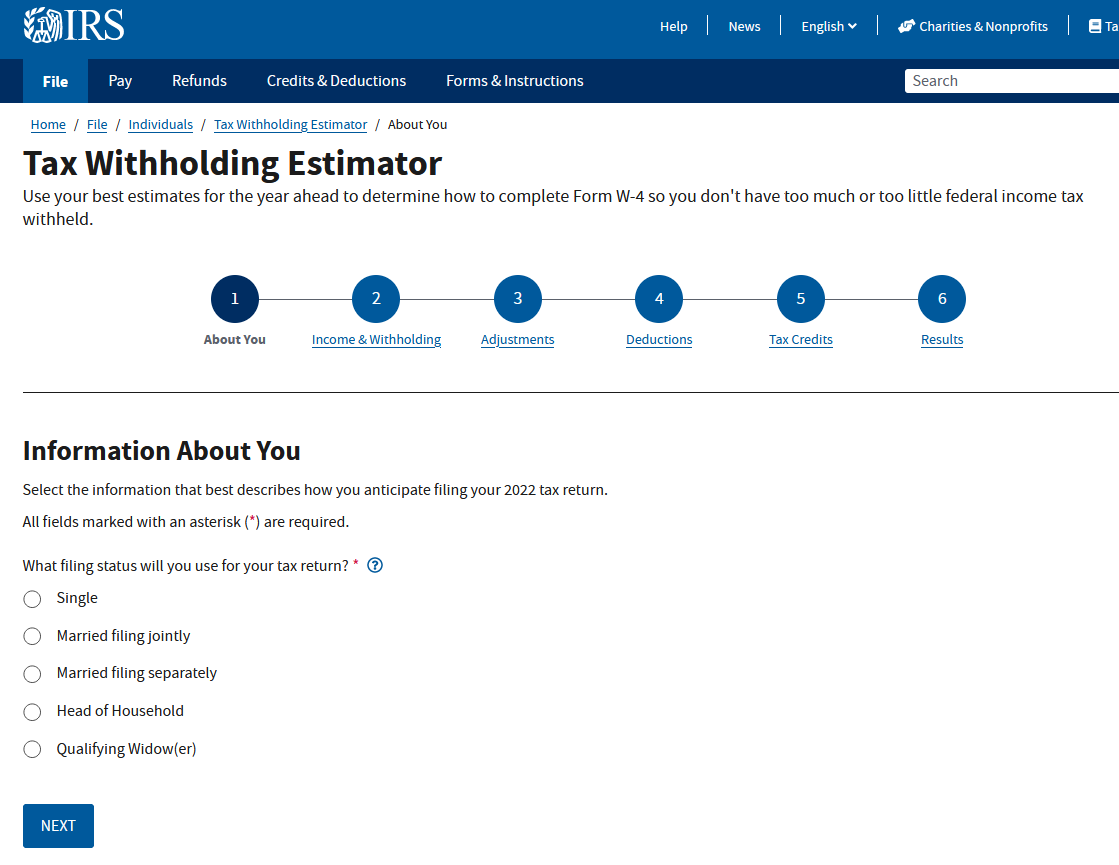

The IRS provides a Tax Withholding Estimator to estimate the federal income tax you want your employer to withhold from your paycheck. You can access the calculator here: https://www.irs.gov/individuals/tax-withholding-estimator

How Does It Work?

The tool will project the total amount of taxes being withheld now and compare it to an estimate of your tax obligation for the year in order to determine if you are having too much or too little withheld. The tool will then help you adjust your withholding accordingly.

What Will You Need

Paystubs for all jobs (spouse too)

Other income info (side jobs, self-employment, investments, etc.)

Most recent tax return

The tool will ask for your filing status, your income & withholding, and any adjustments, deductions, or tax credits you claimed or intend to claim in 2022. After you have entered your information, the Estimator will provide your results for the year ahead to determine how to complete Form W-4 so you don't have too much or too little federal income tax withheld. The entire process can be completed in under 15 minutes!

How to Adjust Your Withholdings

If the Tax Withholding Estimator determines that you are withholding too much or too little, you need to make adjustments to your W-4 form. The link to the 2022 Form W-4 is available here: https://www.irs.gov/pub/irs-pdf/fw4.pdf . However, we recommend that you contact your employer to see if they use an automated system to submit Form W-4. Submit the revised form to your employer, and be sure to check your next paycheck to ensure that the changes have been applied.

State Income Tax Calculator

Although there isn’t an official calculator for state income taxes, there are several available on the Internet that will, based on your circumstances, estimate how much you should withhold each pay period. You can use a similar process as above to adjust your state allowances to ensure you’re withholding the right amount. Note that NJ does not allow many deductions, including charitable contributions!

Here is an example of a calculator we found on the Internet: https://investomatica.com/income-tax-calculator/united-states/new-jersey

What to Do with Your New Monthly Income

If you identified that you were withholding too much in 2021 and adjusted your withholdings accordingly, you have increased your monthly tax home pay. So, what should you do with that additional income? Follow the Baby Steps! https://www.ramseysolutions.com/dave-ramsey-7-baby-steps

Baby Step 1: Save $1,000 for your starter emergency fund.

Baby Step 2: Pay off all debt (except the house) using the debt snowball.

Baby Step 3: Save 3–6 months of expenses in a fully funded emergency fund.

Baby Step 4: Invest 15% of your household income in retirement.

Baby Step 5: Save for your children’s college fund.

Baby Step 6: Pay off your home early.

Baby Step 7: Use your increasing wealth for radical generosity!

Need More Help?

If you are looking for more guidance with a specific situation, we are here to help. Schedule a FinHealth Checkup here: https://www.getfinhealthy.com/checkup/